Loading

Get Form 5227 2011

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Form 5227 2011 online

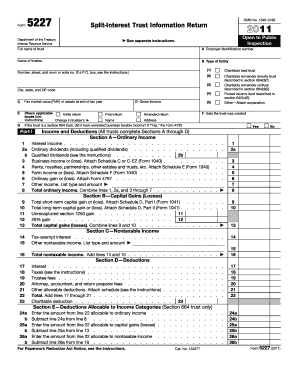

Filling out Form 5227, the Split-Interest Trust Information Return, online can be straightforward with the right guidance. This document is essential for trusts to report income, deductions, and distributions accurately.

Follow the steps to complete the Form 5227 online.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Begin by entering the full name of the trust in the designated field. Ensure that the name matches the legal documents of the trust to avoid any discrepancies.

- Input the Employer Identification Number (EIN) in the next field. This is crucial for identifying the trust’s tax obligations.

- Provide the name of the trustee and their contact information. This section requires accurate details to ensure proper communication.

- Select the type of entity from the provided options. Choose one of the following: charitable lead trust, charitable remainder annuity trust, charitable remainder unitrust, pooled income fund, or other.

- Complete the address fields with the physical location of the trust, including the street address, city, state, and ZIP code.

- Check the applicable boxes for the return type — whether it is an initial return, amended return, final return, or a return due to a change in trustee.

- In Part I, accurately report the gross income of the trust and detail the ordinary income under Section A. This section includes items such as interest income, dividends, business income, and total ordinary income.

- Move to Section B for any capital gains and losses. Record short-term and long-term capital gains, including any unrecaptured section gains.

- Continue to Section C to document any nontaxable income. Include tax-exempt interest and other nontaxable income, if applicable.

- Fill out Section D on deductions. List all allowable deductions, including trustee fees and attorney fees.

- After filling out the income and deductions sections, navigate to Part II to disclose distributions and incomes related to the trust.

- Finally, review all entries for accuracy. Save changes, and if necessary, download, print, or share the completed form as required.

Complete and file your Form 5227 2011 online to ensure compliance with tax regulations.

To file a charitable trust return, complete Form 5227 accurately with all required information about trust activities. Ensure that you follow the instructions carefully to avoid mistakes. After completion, you can e-file or mail the form to the IRS, depending on your chosen method of submission.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.