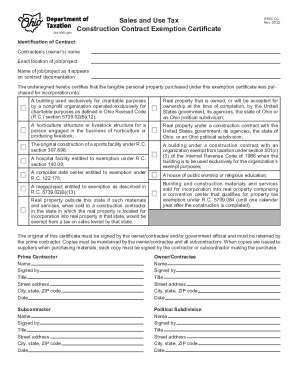

Get Sales And Use Tax Construction Contract Exemption Certificate

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out and sign a form online?

Get your online template and fill it in using progressive features. Enjoy smart fillable fields and interactivity.Follow the simple instructions below:The preparation of lawful paperwork can be high-priced and time-ingesting. However, with our predesigned online templates, everything gets simpler. Now, creating a Sales And Use Tax Construction Contract Exemption Certificate requires not more than 5 minutes. Our state online samples and simple guidelines remove human-prone mistakes.

Follow our easy steps to have your Sales And Use Tax Construction Contract Exemption Certificate well prepared quickly:

- Find the template in the catalogue.

- Type all necessary information in the necessary fillable fields. The intuitive drag&drop interface makes it simple to include or move areas.

- Ensure everything is filled in correctly, without any typos or absent blocks.

- Place your e-signature to the page.

- Click on Done to confirm the alterations.

- Download the papers or print your PDF version.

- Send instantly towards the recipient.

Make use of the quick search and powerful cloud editor to make a correct Sales And Use Tax Construction Contract Exemption Certificate. Remove the routine and create paperwork online!

Generally, services are not subject to sales tax in Ohio, but there's exceptions to every rule. For example, some taxable services in Ohio include: Landscaping or Lawn Care Services. Private Investigative or Security Services.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.