Loading

Get Recapture Of Investment Credit Form 4255

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Recapture Of Investment Credit Form 4255 online

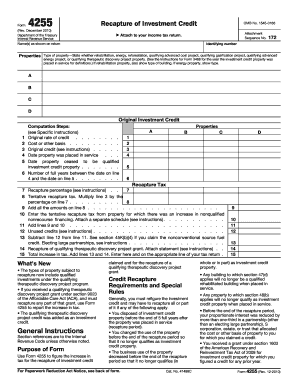

Filling out the Recapture Of Investment Credit Form 4255 is an important step for taxpayers who need to report the recapture of investment credit claims. This guide provides detailed, step-by-step instructions to assist you in completing the form accurately and efficiently online.

Follow the steps to complete the Recapture Of Investment Credit Form 4255 online.

- Click ‘Get Form’ button to access the Recapture Of Investment Credit Form 4255, and open it in the appropriate document editor.

- In section labeled 'Name(s) as shown on return,' enter the names of the individuals or entities as they appear on your tax return. Ensure accuracy to avoid processing delays.

- Provide identifying numbers in the designated field. This typically refers to your Social Security Number (SSN) or Employer Identification Number (EIN).

- In the 'Type of property' section, specify the category of property you are reporting, such as rehabilitation, energy, or qualifying therapeutic discovery project property. Clarifying the type ensures that you follow the correct instructions.

- Fill in the original investment credit sections by entering the original rate, the cost or other basis, and the original credit. Refer to prior Form 3468 for guidance on these values.

- Record important dates in their respective fields. Include the date the property was placed in service and the date it ceased being qualified investment credit property.

- Calculate the number of full years the property has been held, ensuring that if held for less than a year, you enter zero.

- Determine the recapture percentage according to the provided table based on the number of full years from step 7 and enter the percentage in the corresponding field.

- Compute the tentative recapture tax by multiplying the original credit amount by the recapture percentage. Enter this result in the designated field.

- Add any additional amounts from multiple properties, if applicable, ensuring that you summarize them accurately on the total lines provided.

- Assess any unused credits or adjustments, ensuring to reference prior tax years where necessary. This will impact your total tax calculations.

- Review all entered information for accuracy. Make any necessary edits to ensure the form is filled out correctly.

- Save your changes, and when ready, you can download, print, or share the completed Form 4255, ensuring it is submitted with your income tax return as required.

Complete your documents online today to ensure timely and accurate management of your tax obligations.

Investment recapture entails reclaiming tax benefits associated with qualified investments when certain conditions are not met. Investors may need to return credits for various reasons, including selling property or changing business use. Using the Recapture Of Investment Credit Form 4255 assists in formalizing this process.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.