Loading

Get 2011 Form 2441 Instructions

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the 2011 Form 2441 Instructions online

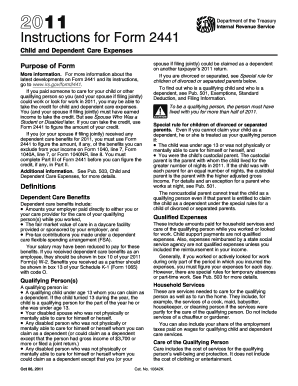

Filling out the 2011 Form 2441 is essential for individuals seeking to claim credits for child and dependent care expenses. This guide provides a comprehensive and user-friendly approach to assist you in completing the form online, ensuring that you understand each section and requirement.

Follow the steps to accurately complete the 2011 Form 2441 online.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Read the purpose of the form carefully to understand if you are eligible to take the credit for child and dependent care expenses based on your qualifying person(s) and earned income.

- Fill out Part I by providing information about the care provider(s), including their names, addresses, and taxpayer identification numbers. Make sure to check the accuracy of the details provided.

- In Part II, enter the names and Social Security Numbers of your qualifying person(s) and the total qualified expenses incurred for their care in 2011.

- Complete the income details required in Part III, ensuring you include all the necessary amounts and deductions related to your earned income and any dependent care benefits.

- Double-check your entries for accuracy to avoid any errors that could affect your credit or be subject to disallowance.

- Once completed, you may save changes, download, print, or share the form as needed.

Prepare your documentation and begin filling out the 2011 Form 2441 online today for an easier tax filing experience.

TurboTax may indicate that you do not qualify for the childcare credit because of specific eligibility requirements not being met. This could include not having eligible dependents or exceeding income limits. To understand the reasons better, refer to the 2011 Form 2441 Instructions and adjust your information accordingly.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.