Loading

Get Form 1120 H Instructions

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Form 1120 H Instructions online

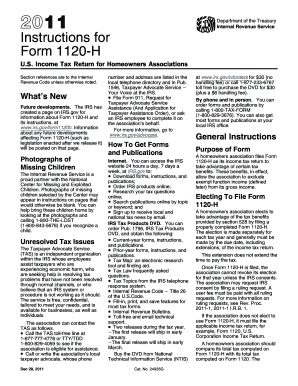

Filling out Form 1120 H, the U.S. Income Tax Return for Homeowners Associations, online can seem daunting. However, with clear instructions and guidance, you can complete the form accurately and efficiently.

Follow the steps to successfully complete Form 1120 H online.

- Click the ‘Get Form’ button to access the Form 1120 H and open it in your online editor.

- Begin by entering the association's true name as stated in its governing documents, along with the address and Employer Identification Number (EIN) at the top of the form.

- Indicate whether this is the final return, if there has been a name or address change, or if this is an amended return by checking the appropriate boxes.

- Complete Item A by selecting the type of homeowners association you are filing for, as outlined in the definitions provided.

- For Item B, ensure that at least 60% of the association's gross income consists of exempt function income.

- Check that at least 90% of expenditures in Item C are for acquiring, building, managing, maintaining, or caring for property.

- Calculate and enter the total expenditures for the year in Item D, according to your accounting method.

- Report any tax-exempt interest in Item E and continue to fill out the form following the provided sections for income, deductions, and tax credits.

- Carefully review all entries for accuracy before finalizing the form.

- Once complete, save the document. You may choose to download, print, or share it as needed.

Take the first step towards completing your Form 1120 H online—start filling it out today!

Related links form

There are several reasons why you might be unable to e-file your federal tax return, such as issues with your individual tax situation or specific forms not available for electronic submission. In some cases, if you are filing your return for the first time, you may require additional verification. It's essential to check the IRS guidelines and the Form 1120 H Instructions for possible solutions to your e-filing difficulties.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.