Loading

Get Wi Dor Schedule Wd 2022-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the WI DoR Schedule WD online

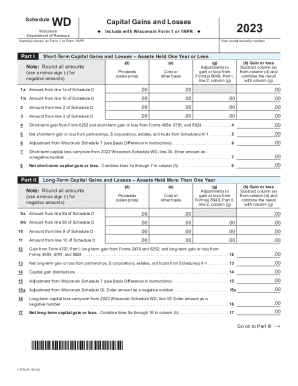

Navigating the Wisconsin Department of Revenue Schedule WD can be straightforward with the right guidance. This guide will provide you with step-by-step instructions to effectively complete the form online, ensuring that you capture all necessary information accurately.

Follow the steps to complete your Schedule WD efficiently.

- Click ‘Get Form’ button to access the Schedule WD and open it for editing.

- Begin by entering your name(s) as shown on Form 1 or Form 1NPR along with your social security number at the top of the form.

- In Part I, provide details for short-term capital gains and losses. You'll need to fill in the proceeds and cost or other basis for each transaction held for one year or less, and make sure to round all amounts. Use a minus sign for any negative amounts and calculate the gain or loss by subtracting the cost from the proceeds.

- Continue detailing all short-term asset transactions, following the same process for each line. Pay special attention to adjustments which may come from Form 8949.

- Once you complete Part I, move on to Part II, focusing on long-term capital gains and losses. Similar to Part I, enter the required details for transactions held for more than one year.

- Complete all calculations necessary to determine the net long-term gain or loss from your assets, ensuring to include adjustments as required.

- Proceed to Part III where you will summarize the gains and losses from both short-term and long-term sections. Make sure to enter the totals accurately, as they will affect your overall capital gain or loss reporting.

- If applicable, complete Parts IV and V related to the computation of Wisconsin adjustments to income and capital loss carryovers. Follow the instructions closely to derive the correct figures.

Start filling out your WI DoR Schedule WD online today to ensure your capital gains and losses are reported correctly.

Schedule D is a form provided by the IRS to help taxpayers compute their capital gains or losses and the corresponding taxes due. The calculations from Schedule D are combined with individual tax return form 1040, which will affect the adjusted gross income amount.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.