Loading

Get Schedule D 1

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Schedule D 1 online

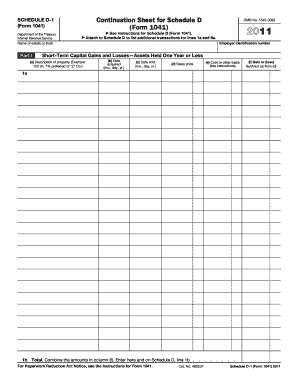

Filling out the Schedule D 1 online can ensure that your estate or trust's capital gains and losses are accurately reported. This guide provides clear, step-by-step instructions to help you complete this form effectively.

Follow the steps to fill out the Schedule D 1 accurately

- Press the ‘Get Form’ button to access the Schedule D 1 form and open it in your browser.

- Enter the name of the estate or trust in the designated field at the top of the form. Make sure the name matches the information shown on Form 1041.

- Provide the employer identification number in the specified section. Ensure that this number is correct as it ties to the estate or trust.

- Move to Part I and begin listing short-term capital gains and losses. For each transaction, fill out the following fields:

- At the end of Part I, combine the total gains and losses from column (f) and write the sum in the designated area. This total will be entered on Schedule D, line 1b.

- Proceed to Part II for long-term capital gains and losses. Repeat the entry process for assets held more than one year, using the same fields described in step 4.

- Combine the totals in column (f) of Part II and enter this total on Schedule D, line 6b.

- Once you have completed all sections, review your data for accuracy. Then, save your changes, and choose whether to download, print, or share the completed form as needed.

Start filing your Schedule D 1 online today for an efficient and organized process.

Related links form

Filing Schedule D can seem complicated, especially if you've had numerous transactions throughout the year. However, when you have organized records of your sales and purchases, the process becomes much simpler. Utilizing tools or platforms like USLegalForms can streamline the documentation process, guiding you through each step of filing Schedule D.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.