Loading

Get 2011 943 Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the 2011 943 Form online

This guide provides comprehensive instructions on filling out the 2011 943 Form online. Whether you are familiar with tax forms or a new user, this step-by-step approach will help ensure your completion of the form is accurate and efficient.

Follow the steps to complete your 2011 943 Form online.

- Click the ‘Get Form’ button to access the 2011 943 Form and open it in your editor for online completion.

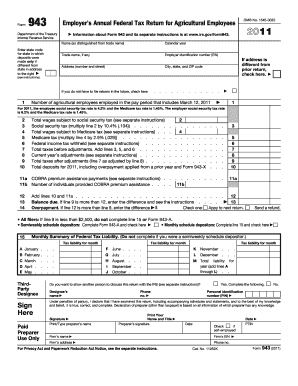

- In the designated fields, enter your calendar year (2011) at the top of the form. Ensure the correct trade name, employer identification number (EIN), and address are filled in as per the instructions.

- Indicate if the address has changed since the last return by checking the box provided. If you do not plan to file returns in the future, mark the appropriate box for this status.

- Provide the number of agricultural employees employed during the pay period that includes March 12, 2011, in the specified field.

- Enter the total wages subject to social security tax in line 2 and calculate social security tax by multiplying the total by 10.4% in line 3.

- Record total wages subject to Medicare tax in line 4 and calculate the Medicare tax on these wages in line 5 by using the applicable percentage.

- Fill in the federal income tax withheld in line 6 and then sum the values from lines 3, 5, and 6 for total taxes before adjustments, noted in line 7.

- If applicable, make any adjustments for the current year in line 8 before calculating the total taxes after adjustments, which will be reflected in line 9.

- Complete the lines related to deposits, COBRA premium assistance payments, and any relevant overpayment details, ensuring accuracy in the amounts recorded.

- Sign and date the form to verify the accuracy of the information provided. If a preparer assisted, their details must also be completed.

- Finally, save, download, or print a copy of the completed form for your records before submitting it as indicated in the instructions.

Take the first step towards completing your 2011 943 Form online today.

To download tax forms like the 2011 943 Form, visit the IRS website or explore platforms like US Legal Forms for an efficient experience. These resources allow you to search and select your required forms seamlessly. With just a few clicks, you can save the forms directly to your device for easy access and filing.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.