Loading

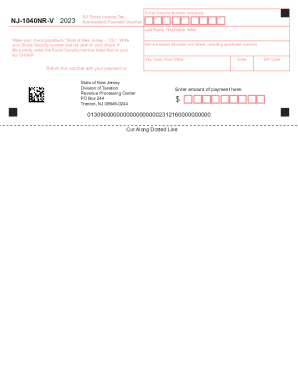

Get Nj Nj-1040nr-v 2022-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the NJ NJ-1040NR-V online

Filling out the NJ NJ-1040NR-V form online is a crucial step for nonresidents making payments towards their New Jersey gross income tax. This guide provides clear, step-by-step instructions to help you navigate the form efficiently.

Follow the steps to complete the NJ NJ-1040NR-V form online.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Enter your Social Security number in the required field. Ensure this is accurate as it is essential for processing your payment.

- Fill in your last name, first name, and middle initial in the designated box. This information should match your Social Security records.

- Provide your home address, including your number and street name. Include any apartment number if applicable, followed by the city or town you reside in.

- Select your state of residence from the dropdown list and enter your ZIP code in the specified field.

- Enter the total amount of your payment in the space provided. Ensure the figures are accurate and reflect the tax owed.

- Review all entered information for accuracy before finalizing your form.

- Save your changes, and if desired, download or print your form for your records. You may also share the form as needed.

Complete your NJ NJ-1040NR-V form online today for a smooth filing experience.

A nonresident serviceperson who has income from New Jersey sources such as a civilian job in off-duty hours, income or gain from property located in New Jersey or income from a business, trade or profession carried on in this State must file a New Jersey nonresident return, Form NJ-1040NR.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.