Get Form 843

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Form 843 online

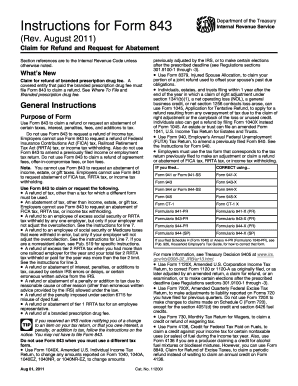

This guide provides a comprehensive overview of how to fill out Form 843, allowing users to claim a refund or request an abatement for various taxes, interest, and penalties. Whether you are a novice or have some experience, this step-by-step approach will assist you in completing the form accurately.

Follow the steps to successfully complete Form 843 online.

- Press the ‘Get Form’ button to retrieve the Form 843 and open it in your document editing interface.

- Enter your social security number (SSN) in the designated field. If you are filing for a joint return, include both your SSN and that of your partner.

- Specify the tax period for which you are requesting either a refund or abatement in the ‘From’ line as applicable.

- Select the type of tax or fee you are claiming from the options provided, marking the appropriate box.

- If applicable, complete the specific lines as instructed for special claims like excess tier 2 RRTA or branded prescription drug fees, ensuring to attach necessary documentation.

- Detail your reasons for requesting the refund or abatement in Line 7, adding any calculations for the amounts involved.

- Attach any required supporting documents, such as Form 8947 needs for branded prescription drug fee claims.

- Review your filled form for accuracy and completeness before proceeding to save your changes, download, print, or share the completed Form 843.

Begin filing your Form 843 online today to ensure your claims are submitted promptly.

Related links form

Yes, Form 843 can be signed electronically if you are submitting it online through the IRS e-file system. This approach provides a convenient method for taxpayers, reducing paperwork. If you opt for traditional mail, ensure that you sign the physical form before sending it. Remember, electronic submission options can streamline your process when filing Form 843.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.