Loading

Get Nj Nj-2450 2022-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the NJ NJ-2450 online

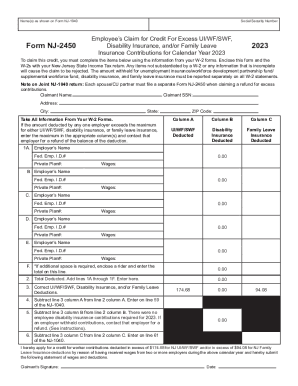

This guide provides clear instructions for completing the NJ NJ-2450 form, which is essential for claiming a credit for excess contributions made towards unemployment insurance and family leave insurance in New Jersey. By following these steps, users with varying levels of experience can navigate the online process easily.

Follow the steps to successfully complete the NJ NJ-2450 form.

- Press the ‘Get Form’ button to access the NJ NJ-2450 document and open it in your preferred online editor.

- Begin by entering your name as it appears on Form NJ-1040 in the designated field for 'Claimant Name'. This ensures accurate identification.

- Provide your Social Security Number (SSN) in the appropriate field to validate your claim.

- Fill in your address, city, state, and ZIP code to provide a complete contact information.

- Refer to your W-2 forms to accurately report the amounts deducted for UI/WF/SWF, disability insurance, and family leave insurance in their respective columns. Make sure to input the correct figures for each employer.

- Calculate the total deductions for each category by adding the amounts from lines 1A through 1F and enter these sums under 'Total Deducted'.

- Complete the calculations for lines 3 through 6 as instructed, using the total deductions to find any discrepancies.

- Sign and date the form to confirm your application for the credit for excessive contributions deducted during the tax year.

- Ensure that you have attached the required W-2 forms to substantiate your claim when submitting your NJ-1040 return.

- Once completed, you can save changes to the form, download a copy for your records, print it out, or share it as necessary.

Start filling out your NJ NJ-2450 online today to ensure your credit for excess contributions is processed smoothly!

New Jersey has a graduated individual income tax, with rates ranging from 1.40 percent to 10.75 percent. There is also a jurisdiction that collects local income taxes. New Jersey has a 6.5 percent to 11.5 percent corporate income tax rate.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.