Loading

Get T2151 Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the T2151 Form online

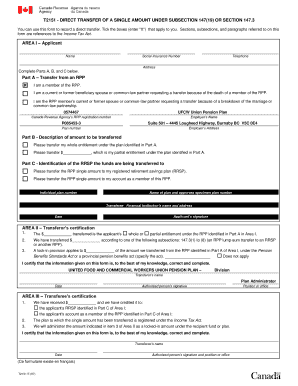

The T2151 Form is used to process a direct transfer of a single amount as outlined under subsection 147(19) or section 147.3 of the Income Tax Act. This guide provides step-by-step instructions on filling out the form online to ensure you accurately complete your submission.

Follow the steps to fill out the T2151 Form online effectively.

- Click ‘Get Form’ button to obtain the form and open it in your browser.

- In Area I, fill in your name, Social Insurance Number, telephone number, and address. Ensure all provided details are accurate.

- Complete Part A by ticking the appropriate box that describes your situation regarding the transfer from a registered pension plan (RPP).

- In Part B, indicate whether you want to transfer your whole entitlement under the plan or specify the partial amount you wish to transfer.

- In Part C, select where the funds are being transferred. Either indicate your registered retirement savings plan (RRSP) or your account as a member of the RPP.

- Provide the individual plan number and name of the plan along with the financial institution’s name and address.

- Sign and date the application to confirm that the information is correct.

- Proceed to the Transferor’s certification section and specify the amounts being transferred and any lock-in provisions that apply.

- Complete the Transferee’s certification with the necessary details, confirming that the received amount has been credited accordingly.

- Once all sections are filled out correctly, save your changes, then download, print, or share the form as needed.

Complete your T2151 Form online today to ensure a smooth transfer process.

You can obtain the CPP application form from the official Government of Canada website or through local Service Canada offices. The online portal provides straightforward access and clear guidance on filling out the form. Additionally, if you need help with retirement funds related to your T2151 Form, US Legal Forms can provide templates and advice to manage your financial documents effectively.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.