Loading

Get Fl Dor Consolidated Sales And Use Tax Return Dr 7 Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Fl Dor Consolidated Sales And Use Tax Return Dr 7 Form online

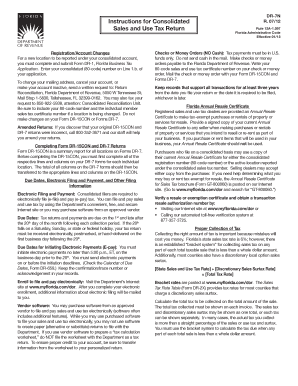

Filling out the Fl Dor Consolidated Sales And Use Tax Return Dr 7 Form correctly is essential for ensuring compliance with Florida's tax regulations. This guide provides clear instructions to help users navigate each section of the form seamlessly, with a focus on filing it online.

Follow the steps to accurately complete your tax return.

- Click ‘Get Form’ button to obtain the form and open it in the appropriate interface.

- Begin by entering your consolidated (80-code) number on Line 1.b. of the application. Ensure to use the correct number for accurate processing.

- In Line A, report the total of all sales transactions, including wholesale and retail sales. Ensure not to include tax collected in this figure.

- For Column 1 of Line A, enter the total amount of gross sales. For Column 2, report all tax-exempt sales and enter '0' if there are none.

- In Column 3 of Line A, calculate the taxable amount by subtracting exempt sales from gross sales. Remember to list tax amounts for separate categories as indicated.

- Line B is for taxable purchases or use tax. Document any purchases made that were not taxed by a supplier and not for resale.

- For Line C, report the total amount of taxable commercial rentals. Repeat the process for Lines D and E for transient rentals and food and beverage vending, respectively.

- On Line 5, sum all amounts in Column 4 from Lines A through E to arrive at the total amount of tax collected.

- Report any lawful deductions you are entitled to on Line 6, ensuring it does not exceed the amount reported on Line 5.

- Line 7 requires you to calculate and enter the total tax due by subtracting Line 6 from Line 5.

- If applicable, complete Lines 8 and 9 regarding estimated tax payments and any credits. Make sure to review the requirements for each line.

- Complete Lines 10 through 14 related to payment calculations, ensuring to check for penalties or interest charges if payment is late.

- Lastly, verify all the information filled in, sign the form where required, and submit. You may save changes, download, print, or share the form for your records.

Start filling out the Fl Dor Consolidated Sales And Use Tax Return Dr 7 Form online today for a smooth filing experience.

Related links form

Generally, the USA does not offer VAT refunds to tourists as many countries do. However, some states have unique rebate programs for certain purchases. While the Fl Dor Consolidated Sales And Use Tax Return Dr 7 Form does not facilitate VAT refunds, tourists should check local regulations for any available benefits.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.