Loading

Get Nyc Htxb Form 2012

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Nyc Htxb Form 2012 online

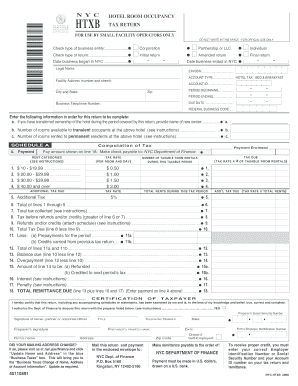

The Nyc Htxb Form 2012 is an essential document for small facility operators to report hotel room occupancy taxes in New York City. This guide will provide clear and supportive instructions on how to accurately fill out the form online.

Follow the steps to successfully complete the Nyc Htxb Form 2012.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Select the type of business entity that applies to you, which may include Corporation, Partnership, LLC, or Individual.

- Indicate the type of return you are filing: Initial return, Amended return, or Final return.

- Provide the date your business began operations in New York City.

- Enter the Legal Name of your business and the Facility Address, including the city and state.

- Fill in your Business Telephone Number and the EIN/SSN required for tax identification.

- Enter your Account Type, ensuring it is categorized as Hotel Tax - Bed & Breakfast.

- Complete the Period Beginning and Period Ending dates to specify the tax period for which you are reporting.

- Fill in the Due Date of this return to keep track of submission deadlines.

- Complete the sections related to room rentals, including the number of rooms available and rented to transient occupants and permanent residents.

- Use Schedule A to compute your tax based on the total rents during this period, following the specific rent category instructions.

- Review the calculations for taxes collected and any adjustments for refunds or credits.

- Certification section: Sign the form where indicated and provide the title and printed name of who is submitting the form.

- If applicable, indicate if your mailing address has changed and follow the directions provided.

- Finally, save your changes, download, or print the completed form to submit it to the Department of Finance.

Complete your Nyc Htxb Form 2012 online today to ensure timely tax filing.

Yes, real estate agents operating as unincorporated businesses in New York City are subject to the NYC UBT. This includes agents working through partnerships or as sole proprietors. It's important for real estate agents to understand their tax obligations to avoid penalties. The Nyc Htxb Form 2012 offers helpful insights into the filing process.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.