Loading

Get W4p

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the W4p online

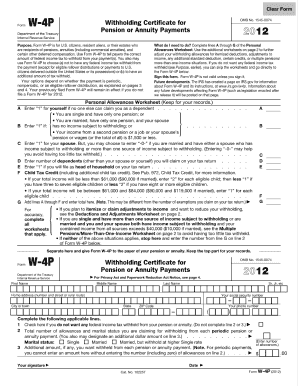

Filling out the W4p form online can streamline your tax process and ensure accurate withholding. This guide provides clear, step-by-step instructions to help you navigate each section of the form with confidence.

Follow the steps to successfully complete the W4p form.

- Click the ‘Get Form’ button to access the W4p form and open it in your preferred editor.

- Begin by entering your personal information at the top of the form, which may include your name, address, and Social Security number. Ensure that all details are accurate to avoid any issues with processing.

- Next, navigate to the section regarding your filing status. You will select the appropriate category that best describes your situation. Take time to review each option before making a selection.

- In the subsequent sections, you will need to input any additional income or deductions. Carefully consider your financial situation to provide accurate figures.

- Review the section on allowances and adjustments. This area requires you to determine the number of allowances you are claiming. Follow the guidance provided in the instructions to ensure accuracy.

- Complete any additional fields pertaining to special circumstances. If applicable, this may include adjustments for dependents or other specific tax situations related to your income.

- Once all fields have been filled out, review your form for any errors. Accuracy is critical to ensure proper withholding.

- Finally, save your changes. You will have options to download, print, or share the form as needed for submission.

Start filling out your W4p form online today for an efficient and accurate tax experience!

Filling out an income tax assessment form involves gathering all necessary income documentation and ensuring accuracy in reporting earnings. The uslegalforms platform can provide you with step-by-step guidance and templates to simplify completing these forms. Following the included instructions closely will ensure your assessment is correct and thorough.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.