Loading

Get Kansas 85a

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Kansas 85a online

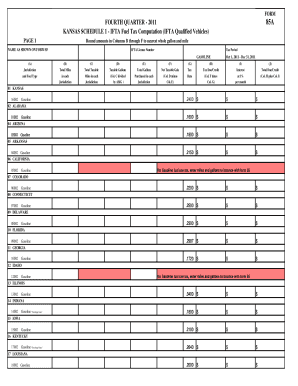

Filling out the Kansas 85a form is an essential step for users involved in IFTA fuel tax computation. This guide provides clear and comprehensive instructions to help you complete the form confidently and accurately.

Follow the steps to complete your Kansas 85a form online

- Press the ‘Get Form’ button to access the document and open it in your online editor.

- In the 'Name as shown on Form 85' field, enter the legal name exactly as it appears on your existing Form 85.

- Input your IFTA license number in the designated area to identify your account.

- Specify the tax period of the report, which in this case is from October 1, 2011, to December 31, 2011.

- For each jurisdiction listed, fill out the total miles traveled in column B, based on your records.

- In column C, record the total taxable miles from each jurisdiction.

- Input the taxable gallons of fuel used in each jurisdiction in column D.

- Complete column E with the total gallons purchased in each jurisdiction.

- Calculate the net taxable gallons by subtracting column E from column D and enter the result in column F.

- Identify the tax rate for each jurisdiction in column G, using the rates provided in the form.

- Calculate the tax due by multiplying the value in column F by the rate in column G and write this in column H.

- If applicable, enter any interest accrued in column I.

- Sum the amounts in columns H and I to determine the total due or credit in column J.

- Once all information is accurately filled out, save your progress, then download, print, or share the filled form as needed.

Complete your Kansas 85a form online today to ensure timely and accurate filing.

Filing a Kansas tax extension is straightforward. You must complete and submit Form K-40 for an extension to the Kansas Department of Revenue. This form grants you an additional six months to file your tax return. However, remember that this extension only applies to the submission of your return, not to any taxes owed. Consider using US Legal Forms to ensure you have the correct forms and to assist you with the Kansas 85a application.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.