Loading

Get Irs Form 9452 For 2018

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the IRS Form 9452 for 2018 online

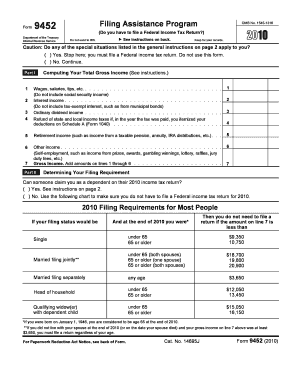

This guide provides clear and concise instructions for users on how to accurately complete the IRS Form 9452 for 2018 online. Understanding this form is essential for determining if you need to file a federal income tax return.

Follow the steps to accurately fill out IRS Form 9452 online.

- Press the ‘Get Form’ button to access the form and open it for editing.

- In Part I, compute your total gross income by entering amounts in the specified fields like wages, interest income, and retirement income. Make sure to combine all applicable sources of income.

- In Part II, determine your filing requirement based on whether someone can claim you as a dependent. Follow the chart to check if your income meets the filing threshold.

- Complete any additional information regarding special situations that might require you to file a federal income tax return, even if your gross income is below the threshold.

- Review the completed form carefully to ensure all entries are accurate and complete.

- Once your form is complete, save any changes, and download, print, or share the document as needed.

Start filling out your IRS Form 9452 online today to ensure your compliance with federal tax requirements.

Filling out IRS Form W-8BEN involves providing your identification details, claiming benefits, and certifying your foreign status. Ensure you enter your name, country of citizenship, and tax identification number accurately. If applicable, follow instructions to fill out sections relevant to claiming reduced withholding tax rates related to IRS Form 9452 for 2018.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.