Loading

Get Td1bc 2012 Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Td1bc 2012 Form online

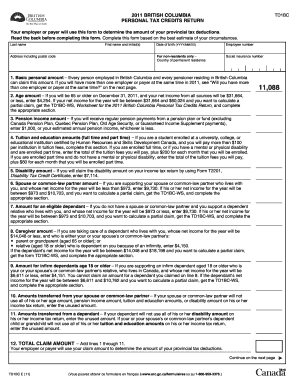

The Td1bc 2012 Form is essential for individuals working in British Columbia or pensioners residing there, as it informs employers or payers about the amount of provincial tax to deduct. This guide provides clear steps to complete the form accurately and efficiently online.

Follow the steps to complete your Td1bc 2012 Form online.

- Click ‘Get Form’ button to obtain the form and open it in an online editor.

- Enter your last name and first name along with any initials in the designated fields. This ensures that your personal information is clearly recorded.

- Provide your complete address, including postal code, to establish your residency for tax purposes.

- Input your date of birth in the format YYYY/MM/DD, which is important for age-related tax credits.

- Fill in your employee number if applicable, which helps your employer track your tax deductions.

- If you are a non-resident, include your country of permanent residence in the specified field.

- Enter your social insurance number, which is necessary for proper tax identification.

- Complete the various credit amounts by following the instructions on the form. This includes claiming the basic personal amount and any applicable age, tuition, disability, and dependant amounts. Make sure to add those amounts in the final section.

- Double-check all entries for accuracy to avoid any potential issues with tax deductions.

- Once you have filled in the required fields and confirmed your information, save your changes. You may also have the option to download, print, or share the completed form as needed.

Complete your Td1bc 2012 Form online today to ensure accurate tax deductions!

To calculate the basic personal amount, refer to the guidelines provided in the TD1BC and the TD1 forms. Each year, the amounts may change, so it is vital to check the latest figures. Utilizing the Td1bc 2012 Form will simplify this process, ensuring that you correctly account for the basic personal amount that applies to you.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.