Loading

Get It 8879

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the IT 8879 online

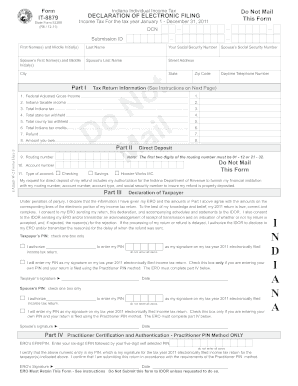

Filling out the IT 8879 form electronically can streamline the process of declaring your electronic filing for Indiana individual income tax. This guide provides you with straightforward, step-by-step instructions to help you navigate and complete the form with confidence.

Follow the steps to complete the IT 8879 online.

- Press the ‘Get Form’ button to access the IT 8879 form and open it in your editor.

- In Part I, enter your first name, middle initial, last name, and social security number. If applicable, provide your spouse's details as well.

- Proceed to Part II and fill in your routing number and account number for direct deposit. Select the type of account you are using.

- In Part III, declare the information is accurate, provide your PIN, and sign and date the form. If applicable, have your spouse do the same.

- Once you have verified the form, you can save changes, download a copy, print it out for your records, or share it as needed.

Complete your IT 8879 form online today to ensure a smooth filing process.

Related links form

Yes, the It 8879 form can be electronically signed when using compatible tax software. This feature simplifies the authorization process as you won’t need to print or physically sign the form. Confirm that your software meets IRS requirements for electronic signatures to ensure proper validation.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.