Loading

Get Bdr Caim Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Bdr Caim Form online

Filling out the Bdr Caim Form online can be a straightforward process when you understand its components and instructions. This guide will provide you with step-by-step directions to ensure your submission is accurate and complete.

Follow the steps to fill out the Bdr Caim Form online effectively.

- Click ‘Get Form’ button to obtain the form and open it for editing.

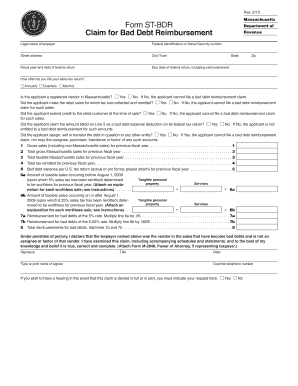

- Begin by entering the legal name of the taxpayer along with their federal identification or social security number. Ensure that all details are accurate to prevent complications.

- Provide the street address, city or town, state, and zip code. This information must be current and reflect the official address of the taxpayer.

- Indicate the fiscal year-end date of the federal return. This is crucial for the matching of financial records.

- State the due date of the federal return, including any valid extensions, to ensure compliance with filing deadlines.

- Select how often the sales tax return is filed: annually, quarterly, or monthly. This will help determine the filing frequency and obligations.

- Answer whether the applicant is a registered vendor in Massachusetts. If not, note that they cannot file a bad debt reimbursement claim.

- Confirm if the applicant made retail sales for which tax was both collected and remitted; an affirmative answer is necessary for eligibility.

- Indicate if credit was extended to the retail customer at the time of sale as this impacts the reimbursement claim status.

- Confirm whether the applicant claimed the amount listed on Line 5 as a bad debt expense deduction on their federal tax return.

- State if the applicant has assigned, sold, or transferred the debt in question to another entity, as this will affect eligibility for reimbursement.

- Complete the financial sections including gross sales, taxable sales, and tax remitted for the previous fiscal year. Each line must be filled out accurately, attaching any required documentation.

- Review the gross sales (including non-Massachusetts sales) and total gross Massachusetts sales for the previous fiscal year; enter these amounts correctly.

- Calculate the reimbursement amounts for bad debts by multiplying the taxable sales identified as worthless by the appropriate tax rates.

- Sign and date the form, providing your title and a daytime telephone number for any follow-up if necessary.

- If a hearing is desired in case the claim is denied, indicate this on the form.

- After finalizing the form, save your changes, and then download, print, or share it as needed for submission to the Massachusetts Department of Revenue.

Complete your Bdr Caim Form online today to ensure proper reimbursement for your bad debt claims.

You can submit a BDD claim as early as 180 days prior to your discharge date. This advanced submission helps ensure that your claims are processed without delays, allowing for timely benefits. Don't forget to fill out the Bdr Caim Form, as it is a key component in the submission process.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.