Get Form Mvu-21 - Mass.gov - Mass

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Form MVU-21 - Mass.Gov - Mass online

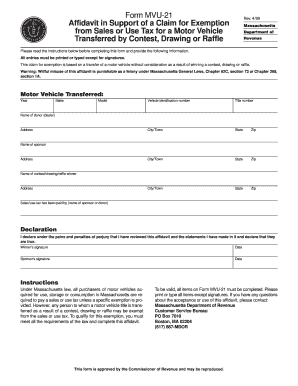

Filling out the Form MVU-21 is essential for claiming an exemption from sales or use tax for a motor vehicle transferred through a contest, drawing, or raffle. Follow this guide to successfully complete the form and ensure your submission is accurate.

Follow the steps to accurately fill out the Form MVU-21.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Begin by entering the details of the motor vehicle transferred. Fill in the year, make, model, vehicle identification number, and title number accurately. This information is crucial to establish the vehicle's identity.

- Provide the city, town, state, and zip code of where the vehicle is currently situated. Ensure these details are correct to facilitate processing.

- Next, input the name and address of the donor (dealer) providing the vehicle. This identifies who is transferring the vehicle.

- Include the name and address of the sponsor of the contest, drawing, or raffle. This information is necessary to validate the transfer.

- Enter the name of the contest, drawing, or raffle winner along with their address. This confirms the individual eligible for the exemption.

- Specify who has paid the sales/use tax by indicating the name of the sponsor or donor. This section is critical for establishing tax accountability.

- Complete the declaration section. Here, both the winner and the sponsor must sign and date the form. This legal affirmation states that the information provided is truthful and complete.

- After reviewing all entries for accuracy, you may choose to save changes, download, print, or share the completed form as necessary. Ensure you retain a copy for your records.

Ensure your exemption claim is processed smoothly by completing the Form MVU-21 online today.

To apply for sales tax exemption in Massachusetts, complete and submit the relevant exemption certificate as outlined on the Mass - Mass website. Identify the specific reason for your exemption, as various categories qualify. You’ll need to provide supporting documents as necessary. By following these guidelines, you can effectively manage your tax liabilities and maintain compliance with state regulations.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.