Get Inheritance Baton Rouge

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Inheritance Baton Rouge online

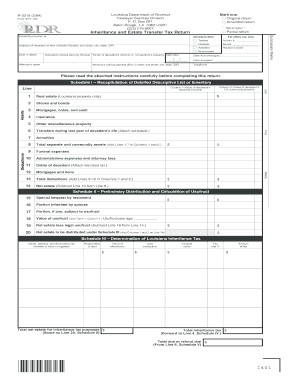

This guide provides clear instructions on how to complete the Inheritance Baton Rouge form online, ensuring a smooth and efficient submission process. By following these steps, users can accurately provide the necessary information required for the inheritance and estate transfer tax return.

Follow the steps to fill out the Inheritance Baton Rouge form online.

- Press the ‘Get Form’ button to access the form and open it for editing.

- Mark the appropriate option for the type of return you are submitting: original return, amended return, or partial return.

- Enter the date of original return, if applicable, and provide the decedent's date of death.

- Indicate whether the decedent had a testate or intestate succession, and fill in their address at the time of death.

- Complete the section for the succession name and receipt number, if relevant.

- Fill out the attorney's name and mailing address, along with contact information.

- Refer to the attached instructions carefully before continuing with the detailed lists.

- Complete Schedule I by listing the value of stocks, bonds, mortgages, and other assets.

- List all deductions, including funeral expenses and debts, in the corresponding lines.

- Calculate the net estate by subtracting total deductions from total assets.

- Move to Schedule II to detail distributions and calculate usufruct values, listing any special bequests.

- Proceed to Schedule III for determining the Louisiana inheritance tax, providing information on heirs and the taxable value.

- Follow to Schedule IV for tax reduction calculations and the determination of any estate transfer taxes.

- Finally, summarize the total amounts due or refunds requested in Schedule V.

- Review the entire form for accuracy, then save changes, and proceed to download or print as needed.

Complete and file your Inheritance Baton Rouge form online today for a streamlined process.

Declaring an inheritance typically involves reporting it on your tax return if it generates income or if the estate exceeds certain federal exemptions. Inheritance Baton Rouge can often be managed more smoothly with legal tools that ensure compliance with all reporting requirements. Using resources like uslegalforms can help simplify the declaration process, providing the necessary forms and instructions tailored for your situation.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.