Loading

Get Pw 1 2010 Form Fillable

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Pw 1 2010 form fillable online

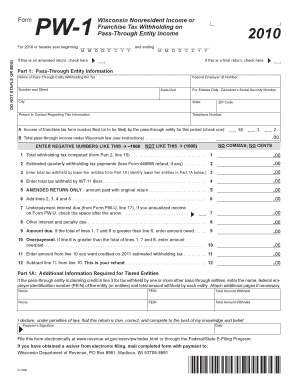

The Pw 1 2010 form fillable is essential for reporting Wisconsin nonresident income and franchise tax withholding on pass-through entity income. This guide will provide clear, step-by-step instructions on how to effectively complete this form online.

Follow the steps to fill out the form accurately online.

- Press the ‘Get Form’ button to access the form and open it in your preferred editing tool.

- In Part 1, enter the pass-through entity information, including the name, federal employer ID number, contact person's details, and the related tax form number applicable for this filing period.

- Provide the total pass-through income under Wisconsin law. Remember to enter negative amounts using a minus sign without any commas or cents.

- Complete lines 1 to 12. You will need to calculate the total withholding tax, estimated quarterly payments, additional information from lower-tier entities, and any overpayments or amounts due. Fill these accurately based on your records.

- In Part 1A, if applicable, provide additional information about lower-tier entities, including their names, federal employer identification numbers, and amounts withheld.

- For Part 2, fill out the information about nonresident shareholders, partners, or beneficiaries. This includes names, addresses, and any relevant identification numbers.

- Declare the information's accuracy by signing and dating the preparer’s section at the end of the form.

- Once the form is completely and accurately filled out, you can save the changes, download, print, or share the form as needed.

Start filing your Pw 1 2010 form online today!

Every employer who is required to withhold Wisconsin income tax must register with the Wisconsin Department of Revenue for a Wisconsin withholding tax account number.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.