Loading

Get 2011 Form 1041 Schedule I

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the 2011 Form 1041 Schedule I online

Filling out the 2011 Form 1041 Schedule I online can be a straightforward process if you follow the appropriate steps. This guide provides detailed instructions to assist you in completing this form accurately and efficiently.

Follow the steps to fill out the form with ease.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Begin by entering the name of the estate or trust at the top of the form. Ensure the name matches the legal documents to avoid discrepancies.

- Next, input the employer identification number in the appropriate field. This number is essential for tax purposes and should be accurate.

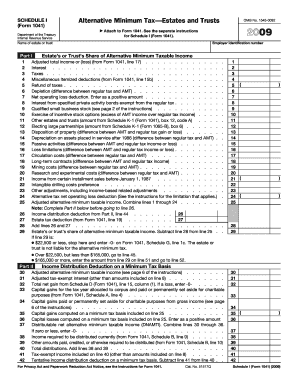

- Proceed to Part I, where you will report the estate’s or trust’s share of alternative minimum taxable income. Carefully fill in each line from 1 to 29, following the form’s prompts and definitions.

- In Part II, calculate the income distribution deduction on a minimum tax basis. It is crucial to determine the correct amounts in order to minimize the tax liability.

- Continue to Part III to compute the alternative minimum tax. Follow the calculations and use the provided guidelines to ensure your results are accurate.

- Complete Part IV if applicable, paying attention to qualified dividends and gains on the appropriate lines. This section involves additional calculations based on previous entries.

- Once all sections are filled out, review your entries to confirm accuracy. Ensure all calculations are correct and all required fields are completed.

- Finally, choose to save your changes, download the form, print it for mailing, or share it electronically as needed.

Start completing your 2011 Form 1041 Schedule I online today for a smooth filing experience.

Schedule 1 is filled out by fiduciaries of estates or trusts that must report certain income. This schedule helps break down additional income that may not directly be listed on Form 1041. If you are managing a trust or estate, ensure you accurately complete the 2011 Form 1041 Schedule I for a thorough report.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.