Loading

Get Canada T1032 E 2022-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to use or fill out the Canada T1032 E online

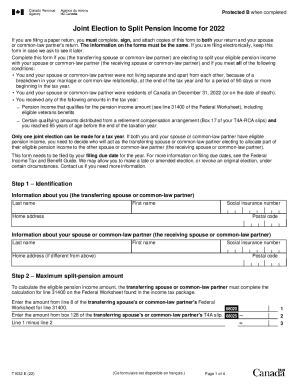

The Canada T1032 E form allows individuals to jointly elect to split eligible pension income between partners. This guide provides a clear, step-by-step approach to filling out the form online, ensuring all necessary information is accurately submitted.

Follow the steps to complete the Canada T1032 E form online.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Calculate the maximum split-pension amount. Refer to line 31400 on the Federal Worksheet for your eligible pension income and fill in the required fields including amounts from your T4A and T4A-RCA slips.

- If your marital status changed during the year, calculate the eligible pension income based on the months you were married or living common-law. Capture relevant adjustments in this section.

- Calculate the adjustment to the pension income amounts for both spouses. Follow the outlined steps to determine the amounts from the transfers.

- Complete the joint certification section by having both partners sign and date the form, confirming the accuracy of the provided information.

- Once all sections are completed, save changes, download, print, or share the form as required to ensure timely submission.

Start filling out the Canada T1032 E form online today to ensure your pension income is split correctly!

For the purpose of the joint election to split pension income, the transferring spouse or common-law partner is the individual who receives eligible pension income and who elects to allocate part of that income to their spouse or common-law partner (the receiving spouse or common-law partner).

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.