Loading

Get Imrf Form 7 12d

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the IMRF Form 7.12D online

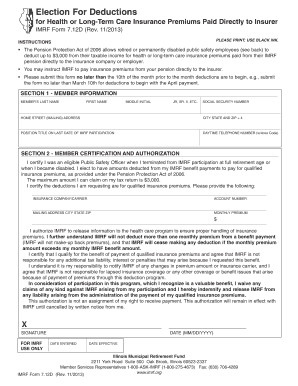

The IMRF Form 7.12D allows retired or permanently disabled public safety employees to deduct health or long-term care insurance premiums from their taxable income. This guide provides step-by-step instructions for completing the form online, ensuring a smooth submission process.

Follow the steps to complete the IMRF Form 7.12D online

- Press the ‘Get Form’ button to obtain the form and open it in your preferred editor.

- Fill in your member information by providing your last name, first name, middle initial, any suffix (e.g., JR, SR), and social security number.

- Enter your home mailing address, including street, city, state, and ZIP code.

- Indicate your position title on your last date of IMRF participation.

- Provide your daytime telephone number, including the area code.

- In the member certification and authorization section, confirm that you were an eligible public safety officer at termination and acknowledge your election to have amounts deducted.

- Provide the name of your insurance company or carrier, your account number, and the mailing address for the insurance.

- Specify the monthly premium amount you wish to deduct.

- Sign and date the form to certify your information and consent to the deductions.

- Once completed, save your changes, then download, print, or share the form as required.

Start completing your documents online today.

IMRF is widely regarded as a reliable pension system, offering a secure source of income after retirement. Many members appreciate the predictable benefits and support provided by IMRF. By utilizing the IMRF Form 7 12d, you can manage your contributions and stay informed about your pension. This proactive approach demonstrates that IMRF can indeed be a solid choice for your retirement planning.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.