Loading

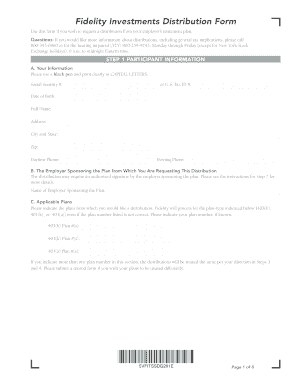

Get Fidelity Distribution Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Fidelity Distribution Form online

This guide provides clear and systematic instructions for completing the Fidelity Distribution Form online. Whether you are requesting a distribution from your employer's retirement plan or need clarification on the process, this guide will support you every step of the way.

Follow the steps to complete the Fidelity Distribution Form online

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Begin by providing your personal information in Section A. Include your Social Security number or U.S. Tax ID, date of birth, full name, address, city and state, zip code, daytime phone number, and evening phone number.

- In Section B, indicate the name of the employer sponsoring the plan from which you are requesting the distribution.

- Move to Section C to specify the applicable plans. Indicate the plan numbers for each type (403(b), 401(k), or 401(a)) and note that if there are multiple plan numbers listed, the distributions will be treated uniformly unless you indicate otherwise in subsequent sections.

- Proceed to Step 2, where you will select the reason for the distribution, such as attainment of age 59½, separation from service, disability, or financial hardship. Ensure that you read the descriptions carefully.

- In Step 3, select your payout request. Choose either a single payment, systematic payment, or combination payout, being mindful to complete the relevant sections based on your choice. If selecting a single payout, decide between full or partial distributions and specify the distribution method.

- After outlining your payout request, indicate how you would like to receive the payments in Step 4. Options include receiving a check by mail, express delivery, or via electronic funds transfer.

- In Step 5, fill out your preferences for income tax withholding, including federal and state taxes, to ensure clarity regarding your financial responsibilities.

- Step 6 requires you to certify your marital status. If married, ensure you understand the requirements for spousal consent and complete that section accurately.

- In Step 7, check if your plan sponsor's approval is necessary. If so, ensure that this section is signed by a valid authority.

- Finally, complete Step 8 by signing the form. Verify all provided information is accurate before submitting.

- Once you have reviewed the entire document, save your changes, and choose to download, print, or share the form as needed.

Complete the Fidelity Distribution Form online to start your distribution process today.

A distribution form for a 401k, such as the Fidelity Distribution Form, allows you to withdraw funds from your retirement account. This form outlines your request for distribution and helps ensure that you comply with IRS regulations. It is crucial to fill it out correctly to avoid delays in receiving your funds.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.