Loading

Get Massmutual 1099 R

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Massmutual 1099 R online

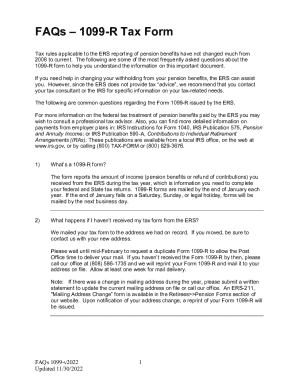

The Massmutual 1099 R is an important form used to report distributions from retirement accounts, pensions, and annuities. This guide will help you understand the form's components and provide step-by-step instructions for filling it out online, ensuring that you complete it accurately and efficiently.

Follow the steps to fill out the Massmutual 1099 R online:

- Click the ‘Get Form’ button to obtain the Massmutual 1099 R form and open it in your preferred editor.

- Identify the recipient’s information at the top of the form. This should include the taxpayer's name, address, and Social Security Number or Tax Identification Number. Make sure to fill out this section carefully, as it is crucial for accurate reporting.

- Review Box 1, which reports the gross distribution amount. Enter the total amount distributed from your retirement account. Double-check for accuracy to avoid discrepancies.

- In Box 2a, indicate the taxable amount. This figure may need to be determined based on previous contributions and the nature of the distribution. Consult your personal tax advisor if you are unsure.

- For Box 7, input the distribution code that represents the nature of the distribution. Each code corresponds to specific situations regarding withdrawals or distributions, so refer to the instructions provided on the form for guidance.

- If applicable, review Box 2b and check the box if the taxable amount is not determined. This may be the case if certain cost basis information is incomplete.

- Complete the form by signing and dating in the designated areas. Ensure that all information is correct, as you will need to submit this form to the IRS and potentially your state tax authority.

- After completing the form, save your changes, then download, print, or share the Massmutual 1099 R as required.

Take the next step in your tax preparation by filling out the Massmutual 1099 R online today.

To determine the taxable amount on your Massmutual 1099 R, first check Box 2a for any specified amount. If it is blank, you'll need to evaluate your contributions alongside the distribution. The IRS provides guidelines for this process, and resources like uslegalforms can assist you in navigating the complexities involved.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.