Loading

Get Irs Form 5305-e

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the IRS Form 5305-E online

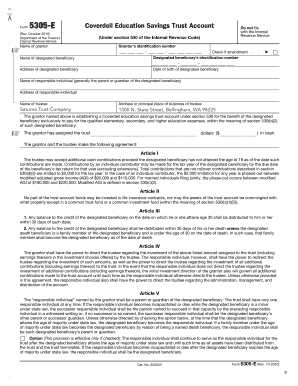

This guide provides clear, step-by-step instructions on how to complete the IRS Form 5305-E online. It aims to assist users, regardless of their legal experience, in successfully filling out this essential document for establishing a Coverdell education savings trust account.

Follow the steps to complete your IRS Form 5305-E online.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Enter the name of the grantor in the first field. This identifies who is establishing the trust account.

- Fill in the grantor’s identification number, which is typically the Social Security number or Employer Identification Number.

- Provide the name of the designated beneficiary who will benefit from this education savings account.

- Check the box if this form is an amendment to a prior submission.

- Input the designated beneficiary’s identification number.

- Complete the address of the designated beneficiary to ensure proper identification.

- Enter the date of birth of the designated beneficiary.

- List the name of the responsible individual, generally the parent or guardian of the designated beneficiary.

- Fill in the address of the responsible individual.

- Write the name of the trustee who will manage the account.

- Provide the address or principal place of business of the trustee, ensuring it's accurate.

- In the amount field, state the cash amount assigned to the trust.

- Read and agree to the terms outlined in Articles I through VIII, which clarify the rules regarding contributions, investments, distributions, and amendments.

- If applicable, check the option regarding the responsible individual continuing their role after the beneficiary reaches the age of majority.

- Sign and date the form at the designated spaces for the grantor, trustee, and witness if necessary.

- Once all fields are filled out accurately, you may save changes and choose to download, print, or share the completed form.

Start completing your IRS Form 5305-E online today!

Filling out IRS Form 5305-E involves several straightforward steps. Begin by providing the necessary details about the plan and the designated beneficiaries. Next, ensure you comply with all IRS requirements to maintain the plan's tax advantages. For a smoother experience, you might find it beneficial to use uslegalforms, where you can access templates and examples tailored to IRS Form 5305-E.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.