Get 5305 Simple Form Vanguard

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the 5305 Simple Form Vanguard online

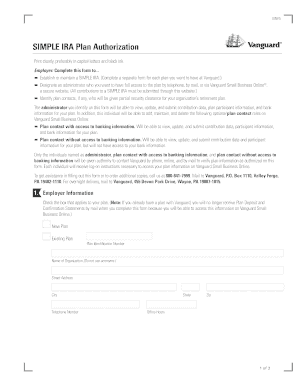

This guide provides users with step-by-step instructions on how to properly fill out the 5305 Simple Form Vanguard online. The clear and comprehensive instructions aim to assist users of all experience levels in completing their forms accurately.

Follow the steps to successfully complete the 5305 Simple Form Vanguard online.

- Click the ‘Get Form’ button to access the 5305 Simple Form Vanguard and open it in the editor for filling out.

- Fill in the required fields, including the employer information. Provide the name of the organization, its street address, city, state, and zip code, as well as a contact telephone number.

- In the administrator information section, enter the name of the individual designated to manage the SIMPLE IRA plan, along with their Social Security number, business telephone number, and email address.

- Provide the names and contact information for any additional plan contacts, including those with and without access to banking information, in the corresponding sections.

- Sign and date the form in the designated section to certify that the information is accurate and that the employer is authorized to appoint representatives for the retirement plan.

- Save the completed form, and proceed to download, print, or share the document as needed.

Complete your forms online to ensure a smooth process.

Yes, employers are legally required to match SIMPLE IRA contributions from employees, enhancing retirement savings. The match can either be a dollar-for-dollar match up to 3% of compensation or a 2% non-elective contribution for all eligible employees. Ensuring compliance with these matching requirements is crucial for maintaining the plan's integrity and employee trust. Utilize resources like the 5305 Simple Form Vanguard for clarity on matching protocols.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.