Get Multistate Adjustable Rate Note - Wsj One-year Libor (form 3526 ...

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

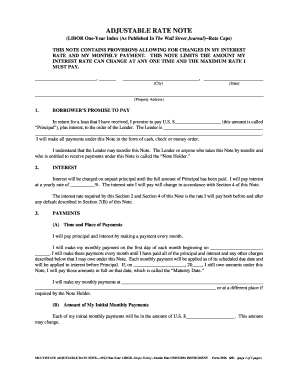

How to fill out the Multistate Adjustable Rate Note - WSJ One-Year LIBOR (Form 3526) online

This guide provides a comprehensive step-by-step approach to filling out the Multistate Adjustable Rate Note - WSJ One-Year LIBOR (Form 3526) online. Whether you are familiar with financial documents or new to them, this guide aims to assist you in completing the form accurately and efficiently.

Follow the steps to complete your form online effectively.

- Press the ‘Get Form’ button to obtain the form and open it in your preferred online editor.

- Begin by entering the date and place at the top of the form. This typically includes the city and state where you are signing the document.

- In the 'Borrower’s promise to pay' section, write down the loan principal amount you received. This is the total amount borrowed, indicated as 'U.S. $_____.' Then fill in the lender's name and address accordingly.

- Next, in the 'Interest' section, specify the yearly interest rate you will be charged. Make sure to follow the guidelines in Section 4 for any changes.

- In the 'Payments' section, enter the date you will begin your monthly payments and specify the amount of your initial monthly payment.

- For the 'Interest rate and monthly payment changes' section, identify the Change Dates and the Index for interest rate adjustments. Enter any required percentage points for rate changes.

- Complete the 'Borrower’s right to prepay' section, noting that you can make payments towards the principal before they are due.

- In the 'Loan charges' section, make sure to include any applicable maximum loan charges that might apply.

- If you are signing the document with multiple borrowers, ensure that all parties fully understand and fill out their obligations as outlined.

- Once you have filled out all required fields, save your changes, and you may choose to download, print, or share the completed form as necessary.

Start filling out your Multistate Adjustable Rate Note online now for a seamless experience.

Determining if an adjustable-rate mortgage (ARM) is suitable in 2025 involves evaluating interest rates, your financial goals, and market conditions at that time. If rates remain competitive and you plan to stay in your home for only a short duration, an ARM might be beneficial. The Multistate Adjustable Rate Note - WSJ One-Year LIBOR (Form 3526) can provide valuable insights and assist you in making informed choices to adapt to the changing market landscape.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.