Loading

Get Form Rtp 91w Property Maintenance & Operations Cost Survey Schedule For Submission To The

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Form Rtp 91w Property Maintenance & Operations Cost Survey Schedule For Submission To The online

This guide provides clear and supportive instructions on how to complete the Form Rtp 91w Property Maintenance & Operations Cost Survey for submission. Designed for users of all experience levels, this resource ensures accurate submission online, facilitating a smooth process.

Follow the steps to fill out the form correctly and efficiently.

- Click ‘Get Form’ button to access the form and open it in your preferred editing tool.

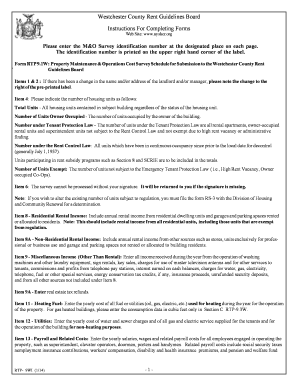

- Enter the M&O Survey identification number in the designated area on each page. This number is located in the upper right corner of the label.

- If there are changes to the landlord's or manager’s name and/or address, write the updated information next to the pre-printed label.

- Indicate the total number of housing units in the building, including owner-occupied units and those under different regulations, as specified.

- Ensure your signature is included, as the survey cannot be processed without it. Forms submitted without a signature will be returned.

- Report annual residential rental income for all housing units, including garages and any exempt units.

- Complete the section for non-residential rental income, detailing income from business-related units and any additional garage or parking income.

- Document miscellaneous income, including various services and potential income sources not related to rental income.

- Fill in the yearly cost for heating fuel, categorizing the data by type of fuel used for the property.

- Enter the total costs associated with utilities, such as water, sewer charges, and gas for non-heating purposes.

- Outline payroll costs associated with property management, including all staff salaries and related payroll expenses.

- List the yearly amounts for real estate taxes as reflected on your Federal income tax return.

- Detail total insurance premiums claimed on your Federal tax return, ensuring to exclude certain insurance types with payroll costs.

- Document management expenses and fees related to the operation and management of the property.

- Account for annual repair and maintenance costs, including service wages and any credits or reimbursements.

- Report interest expenses on outstanding loans associated with property financing.

- Include all operational expenses that do not fall under other categories, mentioning their respective costs.

- Submit the yearly depreciation amounts associated with the property and its operated goods.

- Ensure that when completing related forms, specific instructions regarding reporting and categorization are followed. Note that only whole dollar amounts should be used.

- Upon completion, save your changes, and if necessary, download, print, or share the filled form as per your requirements.

Complete your documents online for a hassle-free submission experience.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.