Loading

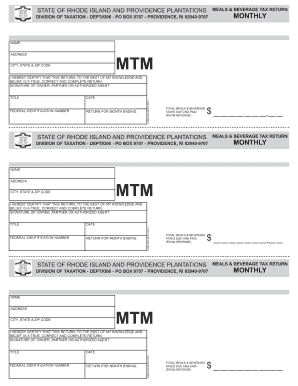

Get State Of Rhode Island: Division Of Taxation:sales And Excise - 1...

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the State Of Rhode Island: Division Of Taxation: Sales And Excise - 1 online

Filling out the State Of Rhode Island: Division Of Taxation: Sales And Excise - 1 form online is a straightforward process. This guide will walk you through each section of the form, ensuring you complete it accurately and efficiently.

Follow the steps to successfully complete your tax return.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Enter your name in the 'Name' field. This should be the name of the individual or business filing the return.

- Provide your address in the 'Address' field. Make sure to include the street address, city, state, and ZIP code.

- Fill out the 'Federal Identification Number' field with your business's federal tax ID number.

- Indicate the month for which you are filing by filling in the 'Return for month ending' field with the appropriate date.

- In the 'Total Meals & Beverage Taxes Due and Paid' section, enter the total amount from Schedule A, which is located on the back of the return.

- Certify the accuracy of your return by signing in the 'Signature of Owner, Partner or Authorized Agent' section.

- Once you have filled out the form, you can save changes, download, or print the completed return for your records.

- If you have no transactions to report, simply enter '0' in the 'Total Meals & Beverage Taxes Due and Paid' line, sign the form, and submit it.

Complete your meals and beverage tax return online today.

Rhode Island imposes a sales tax of 7% on most goods and some services. It is essential for residents and businesses to stay informed about the current rate and applicable laws. For more details regarding the sales tax, insights from the State Of Rhode Island: Division Of Taxation:Sales And Excise - 1... can assist you in navigating these regulations.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.