Get Notice Of Information And Examples Of Amortization Of Home ... - Nccob

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to use or fill out the Notice Of Information And Examples Of Amortization Of Home Loans - Nccob online

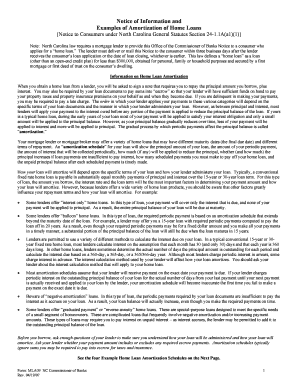

Filling out the Notice of Information and Examples of Amortization of Home Loans form is an essential step for consumers applying for home loans in North Carolina. This guide will walk you through the process of completing this form online, ensuring you provide the necessary information accurately.

Follow the steps to complete the form successfully.

- Use the 'Get Form' button to access the Notice of Information and Examples of Amortization of Home Loans form and open it in your preferred editor.

- Begin with entering your personal information in the designated fields, ensuring to include your full name, contact information, and property details.

- In the section detailing your loan amount, input the principal amount you plan to borrow for your home loan.

- Next, provide the loan term. Specify the duration for which you intend to pay back the loan, typically in years, such as 15 or 30 years.

- Indicate the interest rate connected to your home loan. Make sure to specify whether it is a fixed or variable rate.

- Check any additional required fields related to escrow payments, if applicable. This includes specifying whether your payments will cover property taxes and insurance.

- Review all your entered information for accuracy and completeness. Make any necessary edits to ensure all data reflects your situation correctly.

- Finally, save your changes, then download, print, or share the completed form as needed.

Start filling out your Notice of Information and Examples of Amortization of Home Loans form online today.

Amortization refers to the structured approach of repaying loans over time, while paying off debt is a broader term that encompasses settling any owed amount. When you amortize a mortgage, you break down payments into smaller portions that cover interest and principal. This process helps you visualize your progress toward eliminating debt gradually. In this context, learning more about the Notice Of Information And Examples Of Amortization Of Home ... - Nccob can be beneficial.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.