Loading

Get Indiana Iedc Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Indiana Iedc Form online

This guide provides clear instructions on how to complete the Indiana Iedc Form online, ensuring that your application is accurately filled out and submitted. Follow these steps for a smooth online experience.

Follow the steps to complete your Indiana Iedc Form online.

- Press the ‘Get Form’ button to obtain the Indiana Iedc Form and open it for editing.

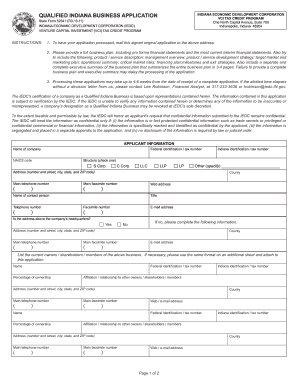

- Begin with the applicant information section. Enter the name of the company along with its NAICS code, federal identification or tax number, and check the appropriate structure (S Corp, C Corp, LLC, LLP, LP, or Other). Provide the company address, main telephone number, county, and web address.

- Identify a contact person by entering their name, title, and contact details, including telephone number and email address. Confirm whether the address provided is the company headquarters.

- If the main address is not the headquarters, fill out the secondary address fields with the relevant information about the company’s headquarters, including Indiana identification or tax number.

- List current owners, shareholders, or members of the business. For each individual, provide their federal identification number, percentage of ownership, affiliation to other owners, and contact details. If more space is needed, include an additional sheet.

- Indicate all services the qualified Indiana business is engaged in by checking the applicable boxes provided in the form.

- Provide financial details, including revenue generated for the last two years, the amount of capital planned for this round, capital from outside Indiana, and total company assets.

- Fill out the employment information, detailing total company employment, and employment of Indiana residents for the specified years.

- Complete the affirmation section, ensuring that the information is accurate and true. Include a signature, printed name, date, and title before submitting.

- Once all sections are completed, review your form for accuracy. Save your changes, and you can either download, print, or share the completed form as needed.

Start filling out your Indiana Iedc Form online now to ensure timely processing of your application.

You can contact the IEDC through their official website, where you will find contact information and resources. Additionally, reaching out via phone or email is an option for more immediate inquiries. For those seeking specific information or guidance, completing the Indiana IEDC Form can also initiate contact and provide your details. The IEDC team is available to assist you with any questions you might have.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.