Loading

Get Amended Irs Form W-8ben - Famguardian

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to use or fill out the Amended IRS Form W-8BEN - Famguardian online

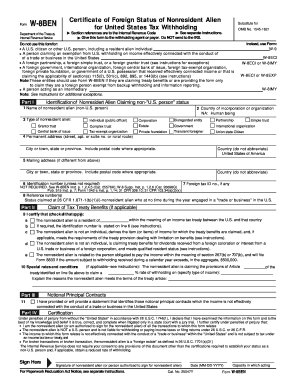

Filling out the Amended IRS Form W-8BEN - Famguardian is essential for nonresident aliens to establish their foreign status and claim any applicable tax treaty benefits. This guide provides clear, step-by-step instructions to assist users in completing the form accurately and online.

Follow the steps to complete the form effectively.

- Click the ‘Get Form’ button to download the Amended IRS Form W-8BEN - Famguardian and open it in your preferred editor.

- Begin by filling out Part I, which identifies the nonresident alien claiming non-U.S. person status. Enter the name of the individual in line 1 and the country of incorporation or organization in line 2.

- Next, provide the type of nonresident alien in line 3, selecting from the available options such as individual, corporation, partnership, etc.

- Enter the permanent address in line 4, ensuring to include the street address, city, state or province, postal code, and country (do not abbreviate). If there is a different mailing address, fill it in line 5.

- For line 6, input your identification number if required. If no number is necessary, refer to the instructions provided.

- In line 7, enter a foreign tax identification number if applicable.

- If any specific reference numbers apply to your form, include them in line 8.

- Move to Part II, where you will certify the applicable treaty benefits in line 9. Check all boxes that apply based on your situation.

- If claiming special rates and conditions, indicate any relevant details in line 10.

- In Part III, confirm if you will provide a statement on notional principal contracts, answering line 11 accordingly.

- Complete Part IV by signing the form and dating it in the specified sections. Ensure that the signature belongs to the nonresident alien or an authorized person.

- Finally, review the completed form for accuracy and save the changes. You can then download or print the form for submission, or share it as needed.

Now that you understand how to fill out the Amended IRS Form W-8BEN - Famguardian online, begin completing your document today.

Yes, the W-8BEN form is obligatory for non-US individuals receiving certain types of income from US sources. It is important to submit this form to benefit from reduced tax withholding rates. Using resources like the Amended IRS Form W-8BEN - Famguardian can ensure you meet all requirements and avoid unnecessary complications.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.