Loading

Get Form 1100s 2012

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Form 1100s 2012 online

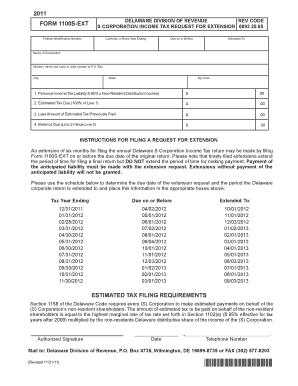

Filling out Form 1100s 2012 online is an important step for S corporations seeking to request an extension for filing their income tax return. This guide provides a detailed, step-by-step approach to make the process as straightforward as possible.

Follow the steps to accurately complete the form online.

- Click the ‘Get Form’ button to access the form and open it in an editor.

- Begin by entering your Federal Identification Number in the designated field.

- Indicate the calendar or fiscal year ending date relevant to your corporation.

- Fill in the due date for submitting the original return, based on the timeline provided.

- Specify the extension date you are requesting in the appropriate box.

- Enter the name of the corporation as it appears in official documents.

- Complete the address section with the number, street, room or suite number, or P.O. Box, city, state, and zip code.

- Calculate your personal income tax liability by multiplying the non-resident distribution income by 6.95% and input the result.

- Record the estimated tax due, which should be 100% of the amount from Line 1.

- If you have previously paid any estimated tax, enter that amount in the designated field.

- Determine the balance due by subtracting the amount of estimated tax previously paid from the estimated tax due.

- Affix the authorized signature, and include the date and telephone number.

- Once all required fields are filled out, save your changes, and you may choose to download, print, or share the form as needed.

Take advantage of this guide and complete your Form 1100s 2012 online today.

Filing a declaration for an old tax regime requires you to clearly state your intent within the tax forms you are submitting. Utilize Form 1100s 2012 to ensure compatibility with your tax filings. Be precise with your entries and keep supporting documents handy. US Legal Forms provides templates that can simplify this process for you.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.