Loading

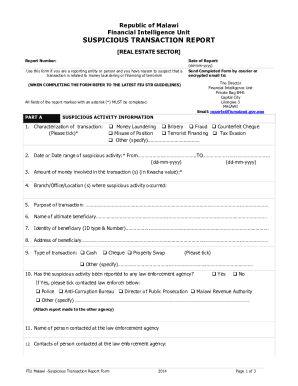

Get Mw Financial Intelligence Unit Suspicious Transaction Report 2014-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the MW Financial Intelligence Unit Suspicious Transaction Report online

This guide will provide you with step-by-step instructions on completing the MW Financial Intelligence Unit Suspicious Transaction Report online. It is crucial for reporting entities and individuals to accurately fill out this form to report suspicious transactions related to money laundering or terrorism financing.

Follow the steps to successfully complete the online form.

- Press the ‘Get Form’ button to acquire the Suspicious Transaction Report form and open it in your preferred online editor.

- Begin with Part A, where you will provide suspicious activity information. Tick the appropriate box that characterizes the transaction you are reporting. You must select one or more options such as money laundering, bribery, or terrorist financing.

- Enter the date or date range of the suspicious activity. Ensure you format your dates as dd-mm-yyyy. Specify the start date and end date.

- Input the amount of money involved in the transaction in Kwacha value. Make sure this section is clear and accurately reflects the transaction details.

- Fill in the branch, office, or location where the suspicious activity took place. This information helps in identifying the transaction's context.

- Specify the purpose of the transaction in the designated field. Be concise and clear, providing enough details.

- Provide the name of the ultimate beneficiary of the transaction, ensuring all spelling is correct for identity verification.

- List the identity type and number of the beneficiary. This may include a national ID, passport number, etc.

- Identify the address of the beneficiary and ensure it is complete with all required details.

- Select the type of transaction from the provided options, such as cash, cheque, or property swap, by ticking the appropriate box.

- Indicate whether the suspicious activity has been reported to any law enforcement agency. If yes, specify which agency was contacted.

- Detail the name and contact information of the person you communicated with at the law enforcement agency.

- Proceed to Part B and provide information about the properties involved in the transaction. This includes the type of property, title holder’s name, property number, and a brief description.

- In Part C, include detailed information regarding the individuals involved in the transaction, including their names, addresses, nationality, and identity types.

- Complete Part D by entering the name and contact details of your institution and the reporting officer.

- In Part E, describe the details of the suspicious activity clearly to demonstrate why the transaction is considered suspicious.

- In Part F, outline the actions taken as a result of the suspicious activity, detailing any steps you have implemented.

- Review Part G, the checklist, to ensure all required documents are attached and all mandatory fields are completed.

- Once all fields are filled, you can save your changes, download the report, and choose to print or share it as needed.

Start filling out your Suspicious Transaction Report online today to ensure compliance and proper reporting.

Filing Timelines – Banks are required to file a SAR within 30 calendar days after the date of initial detection of facts constituting a basis for filing. This deadline may be extended an additional 30 days up to a total of 60 calendar days if no suspect is identified.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.