Get General Power Of Attorney Fillable Recordation Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the General Power Of Attorney Fillable Recordation Form online

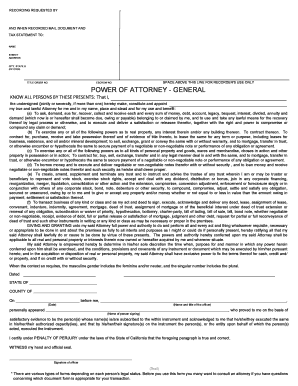

The General Power Of Attorney Fillable Recordation Form allows individuals to grant authority to an appointed representative to act on their behalf in legal and financial matters. This guide provides comprehensive, step-by-step instructions to help users effectively fill out the form online, ensuring clarity and accuracy in the process.

Follow the steps to complete your General Power Of Attorney form online.

- Click ‘Get Form’ button to access the General Power Of Attorney Fillable Recordation Form and open it for editing.

- In the section labeled 'Recording Requested By,' enter the name of the individual or organization requesting the recording.

- In the ’And When Recorded Mail Document And Tax Statement To’ section, fill in the full name and complete street address, including city, state, and ZIP code.

- Enter the title order number and escrow number in their respective fields, if applicable.

- Proceed to the 'Power of Attorney - General' section where you will indicate who is granting the power of attorney by entering their name.

- Detail the powers granted to the attorney-in-fact based on the options provided in the form. This includes authority related to personal and real property, borrowing and lending money, and general business transactions.

- Sign and date the form after completing all applicable sections. Ensure that the signature is placed within the designated area.

- If required, have the form notarized by a qualified officer, who will also sign and add their official seal.

- Once you have completed filling out the form, you can save any changes, download the filled form, print it for physical records, or share it as necessary.

Complete your General Power Of Attorney Fillable Recordation Form online today to ensure your legal matters are handled effectively.

Yes, the IRS does accept power of attorney documents, including the General Power Of Attorney Fillable Recordation Form. This allows individuals to designate someone to act on their behalf regarding tax matters. Make sure the form is filled out correctly, as any mistakes could lead to delays in processing.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.