Loading

Get Il 505

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the IL 505 online

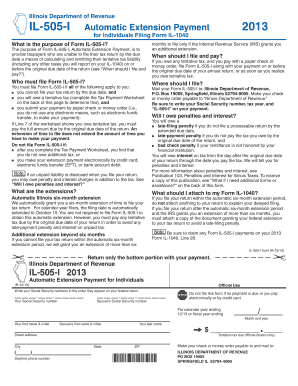

Filling out the IL 505 form online can streamline the process of managing your tax extension payment. This guide provides clear, step-by-step instructions tailored to anyone, regardless of their legal experience.

Follow the steps to complete the IL 505 form online.

- Click 'Get Form' button to obtain the IL 505 form and open it in your preferred editing tool.

- Enter your Social Security number and your spouse’s Social Security number in the order they appear on your federal return.

- Fill in your full name and address, including city, state, and ZIP code to ensure proper identification.

- Input your daytime phone number for any necessary contact regarding your form.

- Complete the Tax Payment Worksheet on the back of the form to determine your tentative tax due. Begin by estimating the income tax and other taxes owed (Line 1).

- Document any Illinois Income Tax withheld and pass-through entity payments (Line 2).

- List your estimated income tax payments for the tax year on Line 3.

- Include any previous payments made with a Form IL-505-I for this tax year on Line 4.

- Specify any estimated allowable credits on Line 5 before calculating the total tax payments and credits on Line 6.

- Determine your tentative tax due by subtracting Line 6 from Line 1 (Line 7). If this amount is $1 or more, proceed to make your payment by check or money order.

- Make your check or money order payable to the Illinois Department of Revenue and mail your form to the provided address.

- At the end, save changes, download a copy, print it for your records, or share the form as needed.

Begin filling out your documents online today for a smoother tax process.

To fill out an Illinois withholding form, gather your personal and employment information first. Be sure to indicate the number of allowances or exemptions securely, utilizing guidance from the IL 505 tax form. This attention to detail will ensure accurate tax withholding and compliance with state regulations.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.