Loading

Get Aessuccess

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Aessuccess online

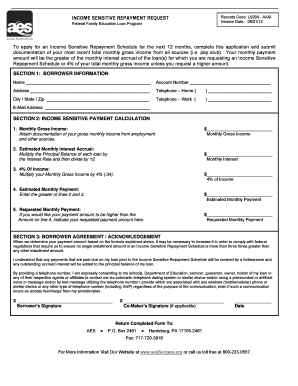

This guide provides comprehensive instructions on completing the Aessuccess form required for requesting an Income Sensitive Repayment Schedule. Clear and supportive guidance is offered to ensure a smooth online experience.

Follow the steps to complete your application effectively.

- Press the ‘Get Form’ button to access the Aessuccess application and open it in the appropriate online editor.

- In Section 1, provide your borrower information. Fill in your name, account number, address, and telephone numbers. Ensure you include a valid email address for any communications.

- In Section 2, begin calculating your Income Sensitive Payment by first reporting your monthly gross income. Attach the required documentation, such as your latest pay stub.

- Next, calculate the estimated monthly interest accrual by multiplying the principal balance of each of your loans by their interest rates, then divide the result by 12.

- Calculate 4% of your monthly gross income by multiplying it by 0.04. This information is essential for determining your payment options.

- Identify the estimated monthly payment by entering the greater amount from either the monthly interest accrual or the 4% of your income.

- If desired, indicate a requested monthly payment amount that is higher than the estimated monthly payment in Section 2.

- In Section 3, read the borrower agreement and acknowledgement carefully. This section includes crucial terms regarding payment amounts and contact consent.

- Finally, provide your signature, and if applicable, a co-maker's signature along with the date of signing.

- After completing the form, you may save changes, download, print, or share the document as required, and ensure it is returned to the designated address.

Complete your Aessuccess form online today to take the next step in your financial journey.

Related links form

The AES, or American Education Services, does not directly influence your credit score but rather reports your repayment history to credit bureaus. Timely payments can positively impact your score, contributing to your financial health. Understanding this relationship is crucial for achieving Aessuccess in managing your student loans.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.