Loading

Get B6d - Schedule D - Creditors Holding Secured Claims - Uscourts

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the B6D - Schedule D - Creditors Holding Secured Claims - Uscourts online

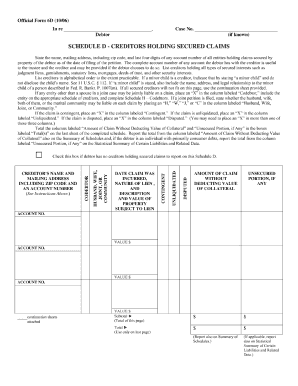

The B6D - Schedule D is a critical part of the bankruptcy filing process, specifically for listing creditors holding secured claims. This guide will help you navigate the completion of this form online, ensuring accurate and complete submissions.

Follow the steps to complete your Schedule D accurately.

- Click ‘Get Form’ button to obtain the document and open it in the appropriate editor.

- Begin filling out the form by entering your name as the debtor and your case number, if known. This information is crucial for identifying your bankruptcy case.

- List each creditor holding a secured claim in alphabetical order. Include the creditor’s name, mailing address, zip code, and the last four digits of the account number. You may provide the full account number to assist the trustee and creditor.

- Indicate the nature of any claims, such as mortgages or other forms of secured interest, and use the designated boxes to denote if the claims are contingent, unliquidated, or disputed.

- If applicable, mark whether there are any codebtors involved in these claims and provide the necessary details if another entity shares liability.

- Make sure to total the amounts in the columns labeled ‘Amount of Claim Without Deducting Value of Collateral’ and ‘Unsecured Portion, if Any’. Report these totals as instructed for your summary.

- If you have additional creditors to report, utilize the continuation sheets provided in the document.

- After completing the form, save your changes. You will have options to download, print, or share the completed document.

Begin filling out your B6D - Schedule D online today to ensure accurate reporting of your secured creditors.

Creditors with unsecured claims do not have any specific property securing the debt. This means they are lower in priority during debt repayment in bankruptcy than secured creditors. Understanding the differences between secured and unsecured claims is essential, especially when referencing B6D - Schedule D - Creditors Holding Secured Claims - Uscourts for claim processes.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.