Loading

Get Ic2 Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Ic2 form online

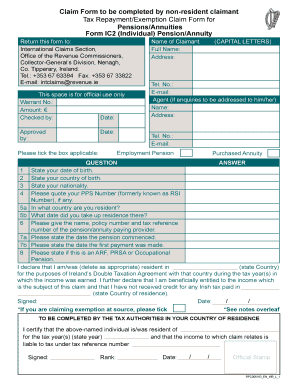

The Ic2 Form is essential for individuals seeking to claim tax repayments or exemptions related to pensions and annuities. This guide provides clear, step-by-step instructions to assist users in completing the form correctly and efficiently online.

Follow the steps to successfully complete the Ic2 form online.

- Press the ‘Get Form’ button to access the Ic2 Form and open it in your documentation tool.

- Begin by entering your personal information in the 'Name of Claimant' section, ensuring you use capital letters as specified.

- Fill out your address in the designated field, again using capital letters to maintain clarity.

- Provide your telephone number and email address in the respective fields, keeping the format professional.

- If applicable, enter the information for your agent, including their name, address, telephone number, and email.

- In the employment pension or purchased annuity section, select the applicable option by ticking the corresponding box.

- Answer the questions numbered 1 to 8 with accurate information. This includes your date of birth, country of birth, nationality, and your PPS number if you have one.

- Specify your country of residence and the date you took up residence there to establish your tax status.

- Provide the name, policy number, and tax reference number of the pension or annuity paying company.

- Indicate the commencement date of the pension and the date of the first payment.

- Declare your residency status in relation to Ireland’s Double Taxation Agreement and confirm your entitlement to the income claimed.

- Sign and date the form where indicated, ensuring you have deleted the incorrect residency status option.

- For claims of exemption at source, remember to tick the corresponding box.

- Review all fields for accuracy before proceeding to save changes, download, print, or share the completed form as needed.

Complete your Ic2 Form online today for efficient tax repayment or exemption processing.

Claiming Irish PSWT from the UK involves several steps that require attention to detail and proper documentation. You will have to provide evidence of your residency, tax obligations, and any applicable forms. Utilizing the Ic2 Form can streamline this process by ensuring you have all the necessary information and documents to support your claim efficiently.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.