Loading

Get Ignore This Form If: You Do Not Have To Make Payments On Account, Or - Hmrc Gov

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to use or fill out the Ignore This Form If: You Do Not Have To Make Payments On Account, Or - Hmrc Gov online

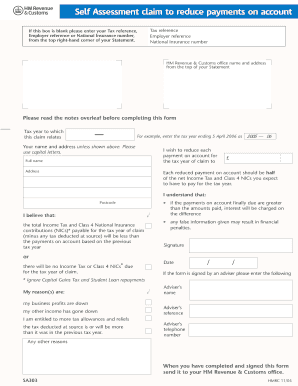

This guide provides clear instructions on filling out the form titled 'Ignore This Form If: You Do Not Have To Make Payments On Account, Or - Hmrc Gov'. It is designed to assist you in understanding the necessary steps to complete the form accurately and efficiently.

Follow the steps to fill out your form correctly.

- Press the 'Get Form' button to access the document and open it in your editor.

- Provide your Tax reference, Employer reference, or National Insurance number in the specified field. If there is no information present, please enter the appropriate number from the top right-hand corner of your Statement.

- Fill in the HM Revenue & Customs office name and address, found at the top of your Statement. Ensure accuracy in this information.

- Indicate the tax year related to the claim. For example, enter the tax year ending 5 April 2006.

- Enter your full name and address in the designated fields, using capital letters as instructed.

- State the amount you wish to reduce each payment on account for the tax year of claim in the appropriate box.

- Remember that each reduced payment on account should be half of the net Income Tax and Class 4 NICs you expect to owe for the tax year.

- Acknowledge your understanding by confirming the statements regarding interest charges on underpayments and the consequences of providing false information.

- Provide your signature and the date of signing the form.

- If an adviser has signed, ensure to include their name and reference details.

- List any reasons for your claim. Select from provided options such as decreased business profits or increased tax allowances.

- Upon completion, send the form to your designated HM Revenue & Customs office. Make sure to keep a copy for your records.

Complete your form online today to ensure accurate processing and prompt responses to your claims.

Related links form

Ignoring HMRC can lead to penalties and interest on unpaid tax liabilities, which can accumulate quickly. It's essential to stay in communication with HMRC and address any tax obligations promptly. You should ignore this form if you do not have to make payments on account, but consider seeking help from uslegalforms to avoid misunderstandings with HMRC.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.