Loading

Get Commercial Risk Rating Form - Bankersonline.com

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Commercial Risk Rating Form - BankersOnline.com online

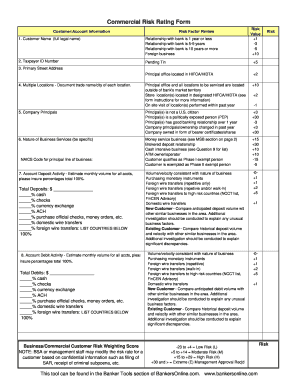

The Commercial Risk Rating Form is a vital tool for evaluating the risk associated with banking customers. This guide will provide you with clear instructions on how to fill out the form accurately and effectively.

Follow the steps to complete the Commercial Risk Rating Form online.

- Press the ‘Get Form’ button to obtain the document and open it in the editor for completion.

- Begin by completing the Customer/Account Information section. Provide the full legal name of the customer and the Taxpayer ID Number, if applicable. Ensure all information is accurate and up-to-date.

- Review the Risk Factor Review section carefully. Assess each risk factor and assign values according to the given scoring scale. Take note of your relationship with the bank and the nature of the customer's business.

- Fill in the Company Principals section. Include relevant details about the principal individuals associated with the company, indicating their citizenship and any relevant banking relationships.

- Complete the Nature of Business Services section. Be specific about the services provided and any classifications that apply. This information will help assess the associated risks accurately.

- Estimate the Account Deposit Activity. Break down the expected monthly volume for all accounts, ensuring all percentages sum to 100%. Include relevant details regarding cash, checks, currency exchange, ACH transfers, wire transfers, and any other transactions.

- Estimate the Account Debit Activity similarly to the deposit activity. Provide the estimates in the required fields and ensure accuracy in your percentages, totaling 100%.

- In the High-Risk Businesses section, if applicable, confirm the customer's compliance with state and local licensing requirements. Respond to all questions and provide explanations where necessary.

- If the customer provides money services, fill out the corresponding sections, ensuring to document all relevant compliance and program details associated with BSA/AML.

- Once all sections are completed, make sure to review the form for accuracy. Save any changes, and prepare to download, print, or share the completed form as required.

Complete the Commercial Risk Rating Form online to ensure accurate risk assessments for your banking customers.

Risk assessment involves identifying, evaluating, and prioritizing risks. The objective is to understand potential impacts on your business and make informed decisions. Using the Commercial Risk Rating Form - BankersOnline, you can systematically assess various risks and strategize accordingly, ensuring your institution is well-prepared.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.