Loading

Get Ftb Form 3816

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Ftb Form 3816 online

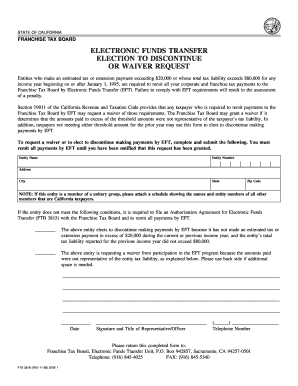

This guide provides clear, step-by-step instructions on how to complete the Ftb Form 3816 online. This form is essential for entities looking to request a waiver from Electronic Funds Transfer provisions or to discontinue EFT payments. Follow the instructions carefully to ensure accurate submission.

Follow the steps to complete the Ftb Form 3816 successfully.

- Press the ‘Get Form’ button to obtain the form and open it for editing.

- Enter the entity name in the designated field, ensuring that it matches the legal name registered with the Franchise Tax Board.

- Provide the entity number exactly as assigned by the Franchise Tax Board.

- Fill in the address, ensuring that it includes the street, city, state, and ZIP code accurately.

- If applicable, attach a schedule showing the names and numbers of other members of the unitary group that are California taxpayers.

- Indicate whether the entity elects to discontinue EFT payments or is requesting a waiver by checking the appropriate box.

- If requesting a waiver, explain in detail why the amounts paid were not representative of the tax liability; use the back of the form if more space is needed.

- Insert the date on which the form is filled out.

- The authorized representative or officer must sign the form, including their title.

- Enter a contact telephone number for follow-up questions from the Franchise Tax Board.

- Review all entries for accuracy before finalizing. Once confirmed, save any changes made, then download, print, or share the completed form as required.

Act now to fill out and submit your Ftb Form 3816 online.

To stop FTB wage garnishment, you can file a claim for an appeal or seek an abatement through the FTB Form 3816. Start by reviewing the amount owed and understand the reasons for garnishment. Additionally, you may want to negotiate a payment plan or ensure that your financial circumstances are accurately reported to the FTB.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.