Loading

Get Hawaii Form Eft 1

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Hawaii Form EFT 1 online

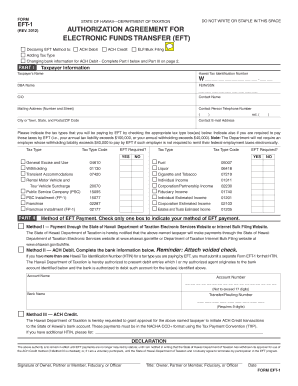

Filling out the Hawaii Form EFT 1 is a crucial step for users looking to authorize electronic funds transfers for tax payments. This guide offers detailed and step-by-step instructions to help users navigate the form efficiently and accurately.

Follow the steps to complete the Hawaii Form EFT 1 online.

- Click the ‘Get Form’ button to obtain the form and open it in your preferred online editor.

- Complete Part I by entering your taxpayer information. This includes your name, Hawaii Tax Identification Number, Doing Business As (DBA) name, Federal Employer Identification Number or Social Security Number, and contact information.

- In Part II, select the types of taxes you will be paying via EFT by checking the appropriate boxes next to each tax type. Also, indicate whether you are required to pay those taxes by EFT.

- Choose your method of EFT payment by checking one of the three methods provided: Method I for online payments, Method II for ACH debit, or Method III for ACH credit. Provide additional information based on your selection.

- If you are using Method II, complete the required bank account information, including account name, account number, bank name, and routing number. Remember to attach a voided check for verification.

- In Part III, if you are changing your bank information, provide the old and new bank account details, including the effective date of the change, and remember to attach a voided check from the new account.

- Sign the form in the designated area. The signature must be from an authorized person, such as the owner, partner, member, fiduciary, or officer.

- Review all details to ensure accuracy, then save your changes. You may also download or print the completed form for your records.

- Upon completion, submit the form as directed, ensuring you also save or share a copy for your personal documentation.

Start filling out the Hawaii Form EFT 1 online today to ensure your electronic tax payments are processed smoothly.

Related links form

To obtain a tax clearance certificate in Hawaii, you should complete an application through the Department of Taxation. This entails filling out the necessary forms and submitting required documentation, including the Hawaii Form Eft 1 if your situation involves electronic funds transfers. Make sure to verify this information for the quickest and most efficient processing.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.