Get Invesco Ira Death Distribution Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Invesco Ira Death Distribution Form online

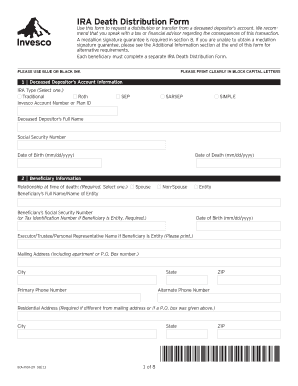

Filling out the Invesco Ira Death Distribution Form online can help streamline the process of managing a deceased depositor’s account. This guide provides clear and detailed instructions to assist beneficiaries in completing the form accurately and efficiently.

Follow the steps to fill out the Invesco Ira Death Distribution Form correctly.

- Click ‘Get Form’ button to obtain the Invesco Ira Death Distribution Form and open it in your preferred online editor.

- Begin by entering the deceased depositor’s account information in Section 1. This includes selecting the IRA type (Traditional, Roth, Sep, SarSep, SIMPLE) and providing the depositor’s full name, Social Security number, date of birth, and date of death.

- In Section 2, fill out the beneficiary information. State the relationship to the deceased, provide the beneficiary's full name, Social Security number or Tax Identification Number, and their date of birth. Also, include the mailing address and primary contact numbers.

- If applicable, in Section 3, list any deceased primary beneficiaries of the decedent and provide their date of death along with a certified copy of their death certificate.

- Complete Section 4 by selecting the distribution/transfer instructions. Choose one of the options (A, B, C, or D) for how the beneficiary would like the funds to be managed. Provide additional details as needed.

- In Section 5, deal with required minimum distributions (RMD). Select the distribution frequency and provide the corresponding details, including start date and transaction day.

- Fill out Section 6 regarding federal income tax withholding. Choose whether to withhold taxes and specify the rate if applicable.

- Decide on payment options in Section 7. Indicate how and where the check should be mailed, or whether to opt for a bank transfer. Ensure to tape a voided check if necessary.

- In Section 8, sign and date the form, certifying the accuracy of the provided information. Make sure a medallion signature guarantee is included if required.

- Finally, review all sections for accuracy. Save changes to your document, then proceed to download or print the form for submission.

Complete the Invesco Ira Death Distribution Form online today to ensure a smooth handling of your distribution request.

Related links form

To report distribution from an inherited IRA, beneficiaries must complete IRS tax forms that capture the details of the distribution. This includes documenting the amount withdrawn and any taxes owed. Using the Invesco IRA Death Distribution Form can help in structuring this process correctly, ensuring compliance with tax obligations while keeping financial records accurate.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.