Loading

Get Basic Quickie Budget

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Basic Quickie Budget online

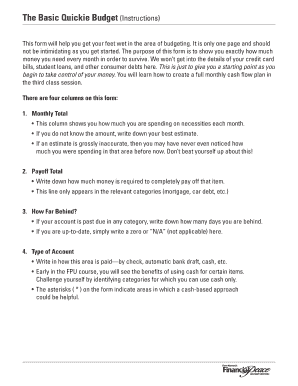

The Basic Quickie Budget is a straightforward tool designed to help you assess your monthly financial needs. By following this guide, you will learn how to effectively fill out the form, ensuring you have a clear understanding of your budget.

Follow the steps to complete your Basic Quickie Budget accurately.

- Click ‘Get Form’ button to access the Basic Quickie Budget. This will allow you to open the form in your preferred digital environment.

- Begin filling in the 'Monthly Total' column for each item listed. This reflects how much you spend monthly on necessities. If you are unsure of the exact amount, provide your best estimate without feeling pressured.

- Next, for relevant categories such as mortgage and car debt, provide the 'Payoff Total'. This indicates how much is needed to completely pay off each item.

- In the 'How Far Behind?' column, note how many days you are past due for any debts. If you are current, record a zero or mark as 'N/A' for those categories.

- Complete the 'Type of Account' section by detailing how each payment is made (for example, check, automatic bank draft, or cash). Consider indicating which categories you might challenge yourself to use cash only, as this can help with budgeting.

- Once all sections are completed, review your entries for accuracy. You can then save your changes, download a copy for your records, print the form, or share it as required.

Start managing your finances by completing your Basic Quickie Budget online today!

Saving $1000 a month while on a low income may seem daunting, but it is possible with careful planning. By implementing a Basic Quickie Budget, prioritize savings first and cut down on non-essential expenses. Small changes, such as meal planning or reducing entertainment costs, can accumulate into significant savings over time.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.