Loading

Get Fs Form 1851

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Fs Form 1851 online

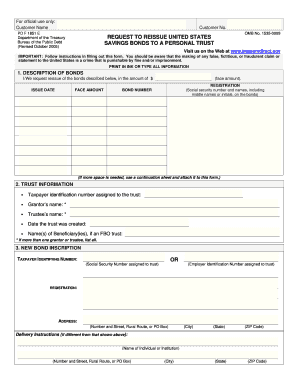

Filling out the Fs Form 1851 is an essential step for reissuing United States savings bonds to a personal trust. This guide provides clear, step-by-step instructions to assist users in completing the form accurately online.

Follow the steps to successfully complete the Fs Form 1851 online.

- Click ‘Get Form’ button to obtain the form and open it for completion.

- In the first section, 'Description of Bonds', provide the amount, issue date, face amount, registration details, and bond number for the bonds you wish to reissue.

- Complete the 'Trust Information' section by filling in the taxpayer identification number assigned to the trust, grantor's name, trustee's name, date of trust creation, and names of any beneficiaries.

- Fill out the 'New Bond Inscription' section with the taxpayer identifying number, registration details, and mailing address for the trust. If different delivery instructions apply, include them here.

- Carefully read the 'Tax Liability Notice' section to understand the implications of reissuing bonds to a trust.

- In the 'Tax Liability Statement', indicate whether you will be treated as the owner of the portion of the trust represented by the tax-deferred accumulated interest on the bonds by marking box a or b.

- Complete the 'Signatures' section by signing the form in the presence of a certifying officer, who must also sign and provide their information.

- Once all sections are filled out, review the form for accuracy, and then save your changes. You can download, print, or otherwise share the form as necessary.

Start completing your Fs Form 1851 online today for a seamless process.

Related links form

Avoiding taxes on inherited savings bonds typically involves understanding the tax implications when they transfer to you as the beneficiary. If you hold the bonds until they mature, the interest may not be taxed until redemption, allowing for potential tax benefits. For more guidance on these aspects, refer to the Fs Form 1851 to navigate your situation carefully.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.